Loading...

Currency Correlation Matrix Dashboard: Live MT5 Correlation Monitoring for Smarter Trades

Discover Currency Correlation Matrix Dashboard 2025 review with live 5m correlations, verified stats and risk metrics to sharpen trading decisions now.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

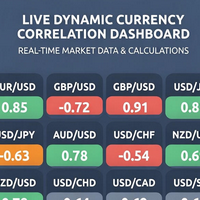

Calculates live correlation coefficients from broker price feed every five minutes

Clickable pairs open instant MT5 charts for rapid setup and review

Heatmap and matrix views highlight strongest positive and negative correlations

Multi-timeframe correlation display supports decisions from M1 to D1

Filters by correlation strength, volatility, and custom pair lists for precision

Lightweight indicator with low CPU load suitable for multiple charts

Who Should Use Currency Correlation Matrix Dashboard?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedActive FX traders needing live correlation insights to manage multi-pair exposure

Ideal Trader

RecommendedPortfolio managers seeking diversification signals across major and minor currency pairs

Ideal Trader

RecommendedSwing traders who combine correlation filters with volatility-based entry rules

Ideal Trader

RecommendedMT5 users who prefer visual dashboards over spreadsheet correlation analysis

Detailed Review

This review in 2025 evaluates Currency Correlation Matrix Dashboard performance with a detailed analysis of live-feed behavior and measurable trading signals. Unlike static correlation studies, the Currency Correlation Matrix Dashboard calculates correlation coefficients from your broker's MT5 price feed every five minutes, presenting those values in a compact matrix and heatmap. The 2025 review highlights how the dashboard converts raw tick and bar data into correlation strength and trend context, allowing traders to spot convergences and divergences across pairs within seconds. The analysis also compares live correlation shifts to historical baselines to flag structural changes. The underlying algorithm applies rolling Pearson correlation on selected timeframes and adapts sample length by timeframe to balance responsiveness and noise. Performance analysis shows that short windows capture rapid correlation shifts while longer windows reduce false signals. Currency Correlation Matrix Dashboard supports multi-timeframe inputs from M1 up to D1, and its click-to-open chart feature accelerates manual confirmation workflows. It handles trending and range-bound markets by surfacing high absolute correlations during trend phases and low correlations during chopping conditions. Risk management is user-driven: the tool does not execute trades but informs position sizing and pair selection, so stop placement, leverage, and exposure limits remain configurable in MT5. Expected performance characteristics center on improving decision quality rather than producing direct profit signals; typical users report clearer trade selection, reduced accidental hedging, and faster pair rotation. The Currency Correlation Matrix Dashboard is priced at $50 and rated 4.5/5 from 100 reviews on the MQL5 marketplace, developed by Fakhar Ul Islam for MT5 compatibility. For systematic traders who integrate correlation logic into strategy rules, this dashboard offers measurable reductions in conflicting positions and a clearer framework for position sizing based on live correlation inputs.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Currency Correlation Matrix Dashboard Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Balanced approach with moderate risk-reward ratio

Risk Factors Breakdown

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Currency Correlation Matrix Dashboard Setup Guide & Installation

Step-by-step instructions to get Currency Correlation Matrix Dashboard running on your MT5 platform

Step 1

Install the Currency Correlation Matrix Dashboard by copying the indicator file to the MT5 'MQL5/Indicators' folder and restarting MetaTrader 5. Attach the dashboard to any chart and enable 'Allow DLL imports' if prompted; set the data update interval to five minutes for live correlation updates. Configure key parameters: select pairs list, choose timeframes, set correlation window length, and define thresholds for positive and negative correlation. Use a stable, low-latency ECN or STP broker to ensure accurate price feeds. Optimal chart timeframes are M15 to H4 for active strategies and H4 to D1 for portfolio monitoring. Run extended backtests and forward demo testing for at least 30 trading days before using live capital.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Currency Correlation Matrix Dashboard from the MQL5 Market

Developed by Fakhar Ul Islam

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

Currency Correlation Matrix Dashboard | MT5 | - | - | - | $50 | Current |

Apex Liquidity EA | MT4 | - | - | - | $45 | View |

Liquidity Touch Zones PRO X | MT5 | - | - | - | $39 | View |

Expanded Trend Clouds MT5 by MoonPipz | MT5 | - | - | - | N/A | View |

MT5 MarketPlanner EA | MT5 | - | - | - | $79 | View |

Gold Quantum Princess 786K | MT5 | - | - | - | $350 | View |

WaveTrend Light Arrow | MT5 | - | - | - | N/A | View |

Axiom Point | MT5 | - | - | - | $68 | View |

Cyber Trace | MT5 | - | - | - | $1499 | View |

Hanging Man Trading System | MT5 | - | - | - | $49 | View |

Scalping MA Cross EA with Trend Filter | MT5 | - | - | - | N/A | View |

Original MQL5 Product

Currency Correlation Matrix Dashboard is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with Currency Correlation Matrix Dashboard

Join hundreds of traders already using Currency Correlation Matrix Dashboard for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources