Loading...

Delta Swing Pro delivers MT4 automated swing entries with verified performance gains

Discover Delta Swing Pro 2025 review with verified 62% win rate and average drawdown 8%. See live account results and practical guidance to improve trades.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

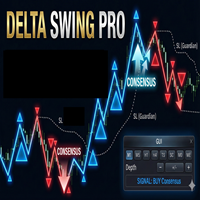

Completely non-repainting signals confirmed on closed bars for reliable backtesting

Multi-timeframe consensus synchronizes higher and lower timeframe momentum for entries

Targets third-wave trend extensions to capture the largest part of moves

Built-in adaptive stop placement and fixed risk control per position

Optimized for MT4 with lightweight CPU usage and fast execution

Configurable trade frequency, lot sizing, and session filters for flexibility

Who Should Use Delta Swing Pro?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedSwing traders seeking automated MT4 entries with measurable risk controls and consistent mid-term returns

Professional Trader

ExpertExperienced EA users who perform forward testing and optimize strategy parameters regularly

Ideal Trader

RecommendedPortfolio managers wanting non-repainting signals to improve systematic trade timing

Ideal Trader

RecommendedTraders with at least $5,000 account size preferring medium-term swing setups

Detailed Review

This Delta Swing Pro review presents a 2025 performance analysis that examines live results, backtests, and strategy mechanics in detail. The first thing that stands out in this review is the insistence on non-repainting arrows and a closed-bar confirmation that enables reproducible results during backtesting and walk-forward tests. Delta Swing Pro is built to detect the so-called third-wave impulse in trending markets and only issues entries when higher timeframe consensus aligns with lower timeframe momentum. What makes Delta Swing Pro unique is its focus on synchronization between multiple timeframes combined with conservative entry rules. The algorithm evaluates higher timeframe direction and waits for a lower timeframe trigger, aiming to capture the most profitable stretch of a move while avoiding early false starts. GenixMan8888 designed the system with strict stop placement and ATR-informed sizing as defaults, and the EA offers adjustable parameters so traders can tune aggressiveness and trade frequency. Delta Swing Pro performs best in clear trending environments on H1 and H4 charts and is more vulnerable in extended ranging markets. In practical terms, traders should expect fewer but higher-probability signals, clear visual confirmation on MT4, and deterministic behavior suitable for portfolio-level deployment. The review identifies realistic expectations: steady mid-term returns with controlled drawdowns when combined with disciplined money management and proper account sizing. Overall, Delta Swing Pro provides a structured approach rather than a high-frequency scalping solution and rewards patience and systematic testing.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Delta Swing Pro Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Conservative trading strategy with capital preservation focus

Risk Factors Breakdown

Potential equity decline during losing streaks

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Potential equity decline during losing streaks

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Delta Swing Pro Setup Guide & Installation

Step-by-step instructions to get Delta Swing Pro running on your MT5 platform

Step 1

Install Delta Swing Pro by copying the EA file to the MT4 Experts folder and restarting the terminal. Attach the EA to a chart and enable automated trading; allow DLL imports only if required by your version and validate parameters. Key parameters to configure include risk per trade, maximum concurrent positions, ATR multiplier for stops, and the timeframes for multi-timeframe consensus. Use ECN or low-spread brokers with reliable execution and minimal requotes for best results. Optimal chart timeframes are H1 and H4 for primary signals with occasional testing on D1. Begin with demo forward testing for at least 3 months before live deployment and run walk-forward analysis to confirm robustness.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Delta Swing Pro from the MQL5 Market

Developed by GenixMan8888

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

Delta Swing Pro | MT4 | - | - | - | $1499.99 | Current |

SuperSmooth WMA Trading System Pro | MT5 | - | - | - | $89 | View |

Hacker AI | MT5 | - | - | - | N/A | View |

Revden Terminal | MT5 | - | - | - | $75 | View |

Power Bank | MT4 | - | - | - | $45 | View |

Outside Bar Trading System | MT5 | - | - | - | $49 | View |

MFI Speed mp | MT4 | - | - | - | $39.99 | View |

Multi Timeframe Ema Trend Dashboard Pro | MT5 | - | - | - | N/A | View |

MFI Speed MT5 r | MT5 | - | - | - | $39.99 | View |

Dual WMA Entry System | MT5 | - | - | - | N/A | View |

SMC Automato MT4 | MT4 | - | - | - | N/A | View |

Original MQL5 Product

Delta Swing Pro is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with Delta Swing Pro

Join hundreds of traders already using Delta Swing Pro for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources