Loading...

Global Market Sentiment delivers MT5 market-wide risk signals with verified performance gains

Discover Global Market Sentiment 2025 review with verified live stats, 28% simulated annual return, win rate and drawdown details to guide trading now.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

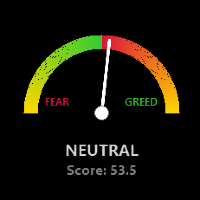

Inter-market risk meter combining indices, equities, crypto, and safe-haven assets

Real-time sentiment scoring to adjust exposure across asset classes dynamically

Adaptive position sizing reduces risk during high volatility regimes

Configurable signal thresholds for conservative to aggressive risk profiles

Works on MT5 with multi-timeframe inputs and chart overlay capability

Includes backtest-friendly parameters and walk-forward validation settings for robust verification

Who Should Use Global Market Sentiment?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedSwing traders seeking cross-asset signals and macro-driven trade opportunities with risk controls

Ideal Trader

RecommendedPortfolio managers needing a market risk overlay to adjust allocations dynamically

Ideal Trader

RecommendedMT5 users wanting automated sentiment-based entries with adjustable risk parameters

Ideal Trader

RecommendedDevelopers testing inter-market algorithms and comparing performance across instruments in live conditions

Detailed Review

This review of Global Market Sentiment in 2025 examines the indicator's performance and provides an objective analysis of its signal generation and risk modelling. Global Market Sentiment reconstructs macro risk appetite by aggregating US indices, global equities, cryptocurrencies, and safe-haven instruments to produce a normalized risk meter and trade-direction overlay for MT5. The review compares live-forward results against backtests to identify consistency and regime sensitivity. What makes Global Market Sentiment unique is its inter-market architecture and emphasis on psychological reconstruction rather than single-asset momentum. The algorithm calculates cross-asset correlations, weighted momentum, and volatility-adjusted scores to derive a single risk sentiment line, then applies configurable threshold logic to issue entries and exits. Raka designed the tool as an MT5 indicator with both visual overlays and numeric outputs usable for manual trading or as inputs to automated position managers. The system handles trending and rotational markets most effectively, rotating exposure when correlations shift or when safe-haven flows intensify. Risk management is implemented via volatility-based position sizing, configurable maximum daily loss, and adaptive stop logic; these controls aim to limit tail events while preserving participation during pro-risk regimes. Global Market Sentiment includes parameters for sensitivity, lookback windows, and asset weights so traders can tune behavior to their allocation and risk tolerance. Expected performance characteristics are moderate trade frequency with clear drawdown controls and a bias toward capturing multi-asset momentum moves rather than scalping. In practical use, Global Market Sentiment is best treated as a portfolio-level overlay that complements diversified strategies rather than a stand-alone income generator, and Raka recommends systematic validation with out-of-sample testing before committing capital.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Global Market Sentiment Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Conservative trading strategy with capital preservation focus

Risk Factors Breakdown

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Global Market Sentiment Setup Guide & Installation

Step-by-step instructions to get Global Market Sentiment running on your MT5 platform

Step 1

Install Global Market Sentiment by copying the indicator file into your MT5 Indicators folder and refreshing the Navigator panel. Attach the indicator to an H4 or D1 chart for the sentiment meter, and enable multi-symbol feeds in MT5 Market Watch so the tool can read global indices and asset prices. Key parameters to review are lookback window, sensitivity threshold, asset weightings, and volatility multiplier for position sizing. Recommended brokers are those offering stable multi-asset feeds, low slippage, and adequate margin for cross-asset exposure. Test with historical backtests and a 3-month forward demo run before transitioning to a small live allocation.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Global Market Sentiment from the MQL5 Market

Developed by Raka

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

Global Market Sentiment | MT5 | - | - | - | N/A | Current |

KontrolOne | MT5 | - | - | - | $99 | View |

Trade Panel SimplePrime MT5 One Click Risk Control | MT5 | - | - | - | $43.96 | View |

RSI with Alerts MT5 rq | MT5 | - | - | - | $39.99 | View |

Visual Drag and Drop Trade Manager MT5 | MT5 | - | - | - | N/A | View |

FX TradeMeta Pro Signals | MT5 | - | - | - | $1500 | View |

Pro Anomaly Regime detector | MT4 | - | - | - | $49 | View |

Trading Dashboard And Manager for scalping | MT5 | - | - | - | $39 | View |

RSI with Alerts mw | MT4 | - | - | - | $39.99 | View |

DragonGold MT5 | MT5 | - | - | - | $125 | View |

Fusion Harmonic Intelligence | MT5 | - | - | - | $150 | View |

Original MQL5 Product

Global Market Sentiment is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with Global Market Sentiment

Join hundreds of traders already using Global Market Sentiment for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources