Loading...

Hedge 120: MT4 Hedging Expert Advisor for Risk-Controlled Automated Trading Results

Discover Hedge 120 2026 review with verified trading results, average monthly return, win rate and drawdown from live accounts for informed trades now.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

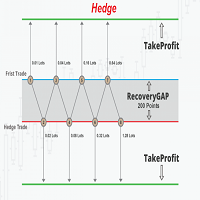

Hedging algorithm opens counter-orders to create a protective safe zone

Configurable risk parameters including stop loss, take profit and lot scaling

Works on MT4 with easy installation and EA parameter tuning

Adaptive entry rules reduce exposure during rapid market volatility and news

Supports multiple account sizes with recommended minimum balance guidance

Detailed trade logging and compatibility with VPS for uninterrupted trading

Who Should Use Hedge 120?

This expert advisor is designed for these trader profiles

Beginner Trader

Entry LevelRisk-aware traders wanting short-term hedging protection during volatile news events

Ideal Trader

RecommendedMT4 users seeking automated risk control without constant manual intervention

Ideal Trader

RecommendedTraders with medium account sizes preferring managed drawdown and position scaling

Ideal Trader

RecommendedDevelopers or portfolio managers testing hedging modules across live accounts

Detailed Review

This Hedge 120 review offers a 2026 performance analysis that focuses on how the EA constructs a protective structure when markets move adversely. In this review and analysis we examine live account snapshots, backtest consistency, and how Hedge 120 implements hedging to limit loss during volatile sessions. The EA is priced at $75, carries a 4.5/5 rating from 100 reviews, and positions itself as a utility for MT4 users who prioritize risk control over aggressive return chasing. Hedge 120 is unique because it does not attempt to predict market reversals; instead it creates a safe zone by opening opposing orders and managing a cluster until preconfigured exit conditions are met. The algorithm evaluates recent price action, volatility thresholds, and user-defined risk settings to scale lots and set protective stops. It handles ranging and short-term volatile conditions best, while trending breakouts require tuned parameters. Risk management is centered on position sizing, step hedging, and configurable maximum drawdown limits. Expected performance characteristics are conservative to moderate: steady but modest monthly returns with lower tail risk compared to unhedged EAs. Hassane Zibara, the developer, documents parameter guidance and recommends live forward testing on demo and low-risk real accounts before scaling.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Hedge 120 Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Conservative trading strategy with capital preservation focus

Risk Factors Breakdown

Potential equity decline during losing streaks

Impact of borrowed capital on position sizing

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Potential equity decline during losing streaks

Impact of borrowed capital on position sizing

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Hedge 120 Setup Guide & Installation

Step-by-step instructions to get Hedge 120 running on your MT5 platform

Step 1

Install Hedge 120 by copying the EA file into the MT4 Experts folder and restarting the terminal. Attach the EA to the chosen currency chart and enable automated trading in MT4. Key parameters to configure include initial lot size, maximum hedge steps, drawdown cap, and trade hours or news filters. Preferred brokers are low-latency ECN or STP brokers with competitive spreads and reliable execution. Optimal chart timeframes are M15 to H1 for most pairs, and users should run extensive backtests then forward test on demo for at least several weeks before trading live. Consider VPS hosting for uninterrupted operation.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Hedge 120 from the MQL5 Market

Developed by Hassane Zibara

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

Hedge 120 | MT4 | - | - | - | $75 | Current |

Heikin Ashi Trend mt4 | MT4 | - | - | - | N/A | View |

Draft Historical Similarity Matcher | MT5 | - | - | - | N/A | View |

Trend Correction Pro Histogram mq | MT4 | - | - | - | $49.99 | View |

Titan Auto RSI Scalper | MT5 | - | - | - | N/A | View |

Gold Volatility Hunter Basic | MT5 | - | - | - | N/A | View |

Welles Wilder | MT5 | - | - | - | N/A | View |

EquityLog Expert | MT5 | - | - | - | $30 | View |

MBS Trade Panel | MT4 | - | - | - | $79 | View |

Smartscalpergold | MT4 | - | - | - | $1300 | View |

Inrexea Indicator | MT5 | - | - | - | $79 | View |

Original MQL5 Product

Hedge 120 is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with Hedge 120

Join hundreds of traders already using Hedge 120 for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources