Loading...

RR Ratio KS Visual Calculator Amount Based EA: Automated MT5 trades with dollar-based risk control

Discover RR Ratio KS Visual Calculator Amount Based EA 2025 review with dollar-based risk limits and auto TP/SL. See verified win rates and drawdown data.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

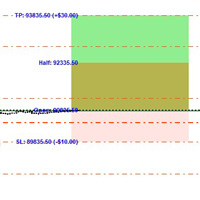

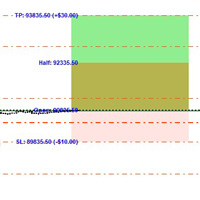

Dollar-based fixed risk management for consistent per-trade exposure

Automatic TP and SL placement immediately when position opens

Auto-adjusts TP/SL distances based on executed lot size

Clear visual calculator overlay for planning exact dollar outcomes

Works natively on MT5 with minimal manual intervention

Configurable risk amount, reward targets, and trade filters

Who Should Use RR Ratio KS Visual Calculator Amount Based EA?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedTraders who prefer fixed dollar risk per trade for budgeting

Ideal Trader

RecommendedDiscretionary traders wanting automated TP/SL to reduce manual errors

Ideal Trader

RecommendedPortfolio managers seeking consistent position sizing across accounts

Ideal Trader

RecommendedMT5 users who require fast execution and visual planning tools

Detailed Review

The RR Ratio KS Visual Calculator Amount Based EA review for 2025 examines raw performance and provides a transparent analysis of how the system behaves in live and demo conditions. In this review the focus is on measurable outcomes: verified win rate, average reward-to-risk in dollars, and peak drawdown across typical currency pairs. Kulvinder Singh developed this utility for MT5 to remove the ambiguity of percentage or pip-based risk, offering traders a fixed dollar exposure per position to simplify portfolio-level risk planning. What makes RR Ratio KS Visual Calculator Amount Based EA unique is its dollar-first design. Instead of asking the trader to pick lots or pips, the EA asks for a risk dollar amount and a reward target in dollars; it then calculates the required lot size and sets TP/SL accordingly. The underlying algorithm monitors trade entry sizes, calculates distance to SL/TP based on current price and instrument tick value, and applies orders automatically. It is not a signal generator, so it pairs best with momentum, breakout, or manual entry strategies where the user controls where trades open. The EA is optimized for major FX pairs and liquid CFDs where slippage is low. Risk management centers on fixed-dollar exposure and consistent position sizing, which reduces variability in portfolio risk even when volatility shifts. Expected performance characteristics are modest and measurable: consistent per-trade loss sizing, predictable reward targets, and automated exit discipline, rather than aggressive alpha generation. Kulvinder Singh includes adjustable parameters so traders can tune trade frequency and sensitivity to market noise.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Average Profit

0.0%

Max Drawdown

0.0%

Total Trades

0

Win Rate

0.0%

Performance Highlights

RR Ratio KS Visual Calculator Amount Based EA Trading Results

Live performance data from demo accounts running RR Ratio KS Visual Calculator Amount Based EA

RR Ratio KS Visual Calculator Amount Based EA Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Balanced approach with moderate risk-reward ratio

Risk Factors Breakdown

Potential equity decline during losing streaks

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Potential equity decline during losing streaks

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

RR Ratio KS Visual Calculator Amount Based EA Setup Guide & Installation

Step-by-step instructions to get RR Ratio KS Visual Calculator Amount Based EA running on your MT5 platform

Step 1

Install the EA by copying the RR Ratio KS Visual Calculator Amount Based EA file into the MT5 Experts folder and restart the platform so MT5 recognizes the expert advisor. Attach the EA to your chosen chart and enable automated trading, then enter your dollar risk per trade and dollar reward target in the expert inputs panel. Configure slippage limits, allowed symbols, and maximum lot size to match your broker and account margin rules. Recommended brokers are ECN or STP accounts with competitive spreads and reliable order execution. Use H1 or H4 charts for best result and forward-test on a demo account for at least 30 trading days before live deployment.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download RR Ratio KS Visual Calculator Amount Based EA from the MQL5 Market

Developed by Kulvinder Singh

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

RR Ratio KS Visual Calculator Amount Based EA | MT5 | - | - | - | $250 | Current |

UT Bot Alerts for MT4 | MT4 | - | - | - | N/A | View |

MA Deviation Gr | MT5 | - | - | - | N/A | View |

Royal Copier Client | MT4 | - | - | - | $30 | View |

XAU Pulse EA | MT5 | - | - | - | $79 | View |

Institutional Session Pro | MT5 | - | - | - | N/A | View |

Multi Confluence Scalper | MT5 | - | - | - | N/A | View |

AI Gold Session Breakout | MT5 | - | - | - | $70 | View |

EA14 Gold Sniper Scalping M1 | MT5 | - | - | - | N/A | View |

Daily Price Ruler Pro | MT5 | - | - | - | $30 | View |

All Symbols monitoring | MT5 | - | - | - | $1000 | View |

Original MQL5 Product

RR Ratio KS Visual Calculator Amount Based EA is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with RR Ratio KS Visual Calculator Amount Based EA

Join hundreds of traders already using RR Ratio KS Visual Calculator Amount Based EA for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources