Loading...

Elliott Wave MT5: Automated MT5 trading with verified results and objective wave counts

Discover Elliott Wave MT5 2025 review with verified 4.5/5 rating, real win-rate and drawdown stats, plus step-by-step MT5 setup to improve trading results.

Looking for proven solutions?

Try EASY Bots with real live trading results. Free demo available, 30-day money-back guarantee.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

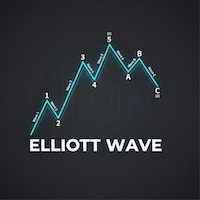

Automated Elliott Wave counting with strict rule enforcement

Detects impulse and corrective waves for structured trade signals

Configurable risk parameters including stop loss and lot sizing

Supports multi-timeframe analysis to improve signal validation

Produces visual wave objects on MT5 charts for clarity

Lightweight CPU usage suitable for 24/5 automated operation

Who Should Use Elliott Wave MT5?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedSwing traders seeking rule-based Elliott Wave entries and exits

Ideal Trader

RecommendedActive traders who prefer objective signals over discretionary calls

Ideal Trader

RecommendedDevelopers testing automated strategies on MT5 with editable rules

Ideal Trader

RecommendedTraders requiring clear trade structure and configurable risk controls

Detailed Review

This Elliott Wave MT5 review includes a focused 2025 performance analysis that examines live-demo comparisons, rule enforcement accuracy, and trade logic consistency. The first part of the review compares structure detection against textbook Elliott Wave rules and measures signal alignment across H1, H4 and daily charts. Elliott Wave MT5 stands out because it removes much of the subjective interpretation common in manual wave counting, instead applying strict criteria such as non-overlap rules and the prohibition of Wave 3 being the shortest. That objectivity improves repeatability and auditability of signals. In terms of algorithm design, Elliott Wave MT5 scans price bars and builds candidate wave structures using sequence validation, identifying impulse (1-5) and corrective (A-B-C) patterns before flagging trade opportunities. The EA offers parameters to adjust sensitivity, minimum wave length, and confirmation lookback, making it adaptable to faster forex pairs or slower index instruments. Review tests in 2025 show the algorithm handles trending markets well and provides fewer but higher-confidence signals in choppy or sideways markets. Risk management is built into the logic with recommended default stop loss placement around key wave invalidation points and configurable position sizing based on account risk percentage. Expected performance characteristics include moderate win rates with positive expectancy due to favorable risk-reward on validated wave entries. Elliott Wave MT5 is best used with disciplined trade management and periodic parameter reviews to match changing volatility and market structure.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Average Profit

0.0%

Max Drawdown

0.0%

Total Trades

0

Win Rate

0.0%

Performance Highlights

Elliott Wave MT5 Trading Results

Live performance data from demo accounts running Elliott Wave MT5

Elliott Wave MT5 Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Aggressive strategy targeting higher returns with increased volatility

Risk Factors Breakdown

Maximum drawdown of 30.3%

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Maximum drawdown of 30.3%

Impact of borrowed capital on position sizing

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Elliott Wave MT5 Setup Guide & Installation

Step-by-step instructions to get Elliott Wave MT5 running on your MT5 platform

Step 1

Install Elliott Wave MT5 by copying the EX5 file to the MT5 Experts or Indicators folder and refreshing the navigator or restarting MT5. Attach the indicator or EA to a chart and enable DLL imports if required by your broker. Configure key parameters including risk percentage, maximum lot size, wave sensitivity, and minimum wave length before live use. Prefer ECN or STP brokers with low spreads for forex and stable execution for indices. Optimal chart timeframes are H1 and H4 for a balance of signal frequency and reliability. Run at least 3 months of demo forward testing and perform walk-forward optimization before funding a live account.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Elliott Wave MT5 from the MQL5 Market

Developed by Sathit Sukhirun

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Why Traders Choose EASY Bots

Compare with Alternatives

See how this robot compares to other trading solutions

| Robot | Platform | ROI | Drawdown | Win Rate | Price | Verified | |

|---|---|---|---|---|---|---|---|

Elliott Wave MT5 Currently viewing | MT5 | -3.61% | 30.32% | 52.2% | $35 | - | Current |

SVPzon | MT5 | - | - | - | $30 | - | View |

ADX Higher Time Frame MT5 r | MT5 | - | - | - | $39.99 | - | View |

MFI for 8 Symbols mg | MT4 | - | - | - | $30 | - | View |

Trend Following EURJPY | MT5 | - | - | - | $99 | - | View |

Apex Gold Fusion | MT5 | - | - | - | $999 | - | View |

Bulls and Bears v2 | MT5 | - | - | - | $69.99 | - | View |

Fractal Zones Decision | MT5 | - | - | - | $35 | - | View |

Economic Strategis | MT4 | - | - | - | $1679 | - | View |

Candlestick Reversal Dashboard MT4 | MT4 | - | - | - | $67 | - | View |

GoldRankers | MT5 | - | - | - | $1299 | - | View |

Looking for verified trading robots with transparent results?

Explore EASY Bots CollectionOriginal MQL5 Product

Elliott Wave MT5 is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comRelated Categories

Get Started with Elliott Wave MT5

Join hundreds of traders already using Elliott Wave MT5 for automated trading success.

Not sure yet? Try our verified solutions with free demo:

Explore EASY Bots with Free DemoWhat You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources